-------------

The utterly clueless Dr. Reich again pontificates about something he clearly knows nothing about. Or rather, like a good little leftist he fulfils his agitprop duties once again, furthering The Narrative in pursuit of The Agenda.

Most of us don’t have paychecks that automatically increase to cover the rapidly-increasing costs of just about everything. As a result, inflation is making most of us poorer.

But recipients of Social Security just got the largest inflation adjustment in four decades — 8.7 percent — effective December 2022.

The media talk about this as a “boost” in Social Security benefits but it’s not. The adjustment simply enables people living on Social Security (more than 70 million of us) to maintain the purchasing power they had a year ago.

And it doesn’t even accomplish this, because medical and drug costs take a higher percentage of older Americans’ budgets than other Americans and have been rising even faster than inflation. (Dr. Reich clearly communicates the problems associated with Social Security. However, he never makes the connection that this is a government program, a centerpiece program created by leftists decades ago, and it's failing by his own admission.)

On the other hand, the people working at the federal minimum wage haven’t got an inflation adjustment. They’ve been getting poorer at a faster pace and for a longer time than most of the rest of us. (This is a faulty analysis. Dr. Reich needs to take into account the demographics and other statistical data.

First of all, only 1.2% of hourly workers are at the minimum wage:

In 2021, 76.1 million workers age 16 and older in the United States were paid at hourly rates, representing 55.8 percent of all wage and salary workers. Among those paid by the hour, 181,000 workers earned exactly the prevailing federal minimum wage of $7.25 per hour.Second, the age distribution of minimum wage earners is substantially tilted to young workers, particularly those who are in their very first jobs:

Minimum wage workers tend to be young. Although workers under age 25 represented nearly one-fifth of hourly paid workers, they made up 44 percent of those paid the federal minimum wage or less. Among employed teenagers (ages 16 to 19) paid by the hour, 4 percent earned the minimum wage or less, compared with 1 percent of workers age 25 and older...

Here's the chart:

Third, the percentage of hourly workers making the minimum wage has dropped precipitately over the last 40 years, from 20% to less than 3%:

Fourth, most states have their own minimum wages, which means the national minimum wage is exceeded by state laws:

- Alabama No state minimum wage law

- Alaska $10.34 per hour

- Arizona $12.15 per hour

- Arkansas $11.00 per hour

- California $13.00 for employers with 25 or fewer employees. Will increase to $14.00 per hour on January 1, 2022 and $15 per hour on January 1, 2023; $14.00 for employers with more than 25 employees (will increase to $15.00 per hour on January 1, 2022

- Colorado $12.32 per hour

- Connecticut $12.00 per hour

- Delaware $9.25 per hour

- Florida $8.65 per hour

- Georgia $5.15 per hour

- Hawaii $10.10 per hour

- Idaho $7.25 per hour

- Illinois $11.00 per hour. Will increase by $1 on January 1 of each year until reaching $15 per hour in 2025

- Indiana $7.25 per hour

- Iowa $7.25 per hour

- Kansas $7.25 per hour

- Kentucky $7.25 per hour

- Louisiana No state minimum wage law

- Maine $12.15 per hour

- Maryland $11.60 per hour for employers with fewer than 15 employees; $11.75 per hour for employers with 15 or more employees

- Massachusetts $13.50 per hour

- Michigan $9.65 per hour. Will increase to $9.87 per hour in first calendar year following a year in which the annual unemployment rate was lower than 8.5%)

- Minnesota $10.08 per hour

- Mississippi No state minimum wage law

- Missouri $10.30 per hour

- Montana $8.75 per hour for businesses with gross annual sales of more than $110,000; $4.00 per hour for businesses making less than $110,000 and not covered by federal statute

- Nebraska $9.00 per hour for employers with more than three employees

- Nevada $8.00 per hour for employees qualifying for health benefits and $9.00 for employees without health benefits. Both tiers will increase by 75 cents on July 1 of each year until reaching $11 per hour and $12 per hour in 2024

- New Hampshire $7.25 per hour

- New Jersey $12.00 per hour. Will increase by $1 on January 1 of each year until reaching $15 per hour in 2025

- New Mexico $10.50 per hour

- New York $12.50 per hour statewide; $15 per hour in New York City, Long Island and Westchester County

- North Carolina $7.25 per hour

- North Dakota $7.25 per hour

- Ohio $8.80 per hour

- Oklahoma $7.25 per hour for employers of ten or more full time employees at any one location and employers with annual gross sales over $100,000; $2 per hour for all other employers

- Oregon $12.00 per hour statewide standard; $13.25 per hour in the urban area around Portland; $11.50 per hour in non-urban parts of the state

- Pennsylvania $7.25 per hour

- Rhode Island $11.50 per hour

- South Carolina No state minimum wage law

- South Dakota $9.45 per hour

- Tennessee No state minimum wage law

- Texas $7.25 per hour

- Utah $7.25 per hour

- Vermont $11.75 per hour. Will increase to $12.55 per hour in 2022 with future increases pegged to inflation

- Virginia $7.25 per hour

- Washington $13.69 per hour statewide. Will change on January 1 of each year based on the federal Consumer Price Index; $16.69 per hour in Seattle; $16.57 per hour in SeaTac

- West Virginia $8.75 per hour

- Wisconsin $7.25 per hour

- Wyoming $5.15 per hour

- District of Columbia $15.00 per hour

- Guam $8.75 per hour

- Puerto Rico $7.25 per hour

- U.S. Virgin Islands $10.50 per hour

So, for a large swath of workers, the minimum wage isn't even relevant.)

The federal minimum wage is still $7.25 — just where it was in 2009, the last time the minimum wage was adjusted. (It’s the longest period of time without a minimum-wage adjustment since the federal minimum wage was put into place in 1938.)

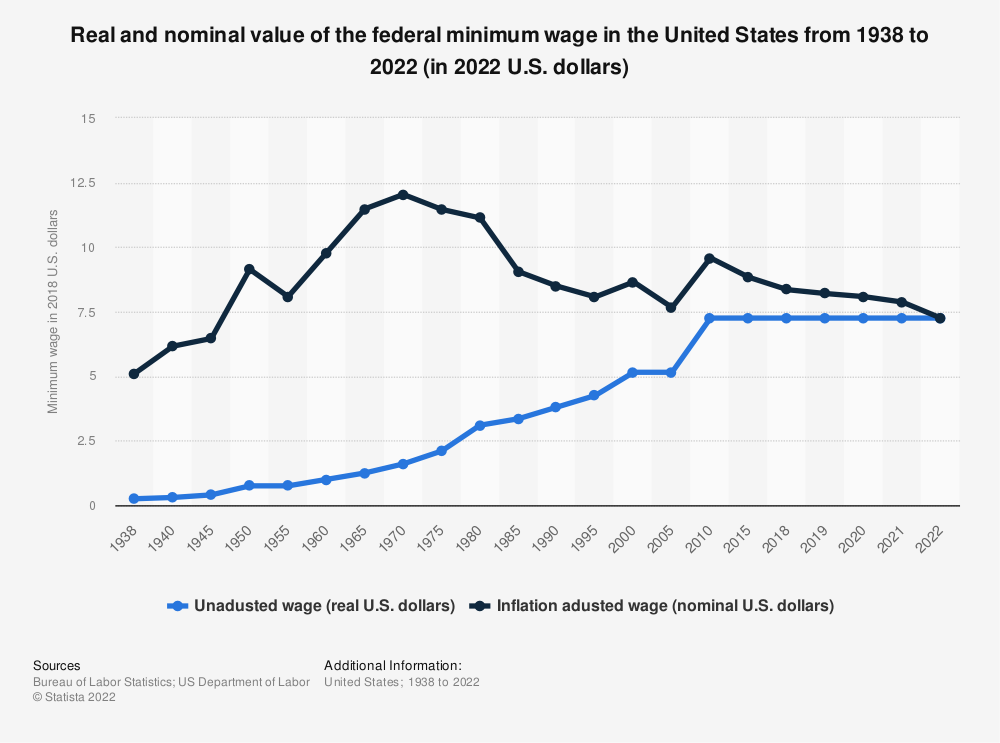

The chart below shows (in black) the real (inflation-adjusted, actual purchasing power) value of the minimum wage since its passage in 1938. (The blue line shows the nominal — non-inflation-adjusted — value.) (Ah, so Dr. Reich can show statistics, but only those that serve his narrative.)

Workers paid the federal minimum of $7.25 today earn 23 percent less than what they (or their counterparts) earned 13 years ago, after adjusting for inflation, and 36 percent less than in 1968.

This is bizarre, to say the least. As a nation, we’re far richer than we were in 1968. Per capita GDP then was just over $24,000. Today, it’s almost $60,000. (This is a little bait-and-switch. Per capita GDP has nothing to do with wages. Dr. Reich is trying to suggest that "we" can afford to "give" an increase to the living wage.

But more to the point, a worker earning $24,000 per year in 1968 would need to earn $183,000 in 2022 just to match inflation. So Dr. Reich's premise is completely wrong, we are clearly not "far richer.")

Because of Congressional inaction on the federal minimum, over two dozen states and several cities have raised their own state minimum wages. (Ah, so after citing his facts and figures, he tacitly admits they are wrong.)

Because of Congressional inaction on the federal minimum, over two dozen states and several cities have raised their own state minimum wages. (Ah, so after citing his facts and figures, he tacitly admits they are wrong.)

But in the rest of the country, states have punished low-wage workers by refusing to raise minimum pay. 26 states have gone so far as to pass laws prohibiting local governments from raising their minimum wage. (Take a look at the above list of states. About a half dozen of them have no minimum wage laws, which means at least 20 of the 26 states criticized by Dr. Reich actually have state minimum laws. If a state prohibits local governments from establishing their own minimum wage laws, it means they must defer to state laws. This seems perfectly reasonable to us.)

Why doesn’t the minimum wage rise with inflation, like Social Security? (Why should it?)

A big part of the reason is that big corporations and their trade associations — especially big retailers and restaurant chains — have lobbied intensely against any minimum wage increase. Their political power continues to grow even as the real value of the minimum wage continues to shrink.

Remember: Corporations pay for the minimum wage. Taxpayers pay for Social Security. (No, consumers pay for the minimum wage, because payroll is a cost of doing business and gets included in the price of the product. Consumers are taxpayers, so the cost of the minimum wage, like every harebrained leftist government program, is borne by the individual taxpayer.

Why doesn’t the minimum wage rise with inflation, like Social Security? (Why should it?)

A big part of the reason is that big corporations and their trade associations — especially big retailers and restaurant chains — have lobbied intensely against any minimum wage increase. Their political power continues to grow even as the real value of the minimum wage continues to shrink.

Remember: Corporations pay for the minimum wage. Taxpayers pay for Social Security. (No, consumers pay for the minimum wage, because payroll is a cost of doing business and gets included in the price of the product. Consumers are taxpayers, so the cost of the minimum wage, like every harebrained leftist government program, is borne by the individual taxpayer.

So Dr. Reich, why would businesses oppose increases to the minimum wage? How about because payroll is the single largest operating expense for most every business? If a business must dedicate more of its resources to wages, then either prices will need to increase or the number workers will need to be scaled back.

Money doesn't just appear out of nowhere [except in government...]. And small-to-medium businesses employ most of the workers and provide most of the new jobs:

- Employer firms with fewer than 500 workers employed 46.4% of private sector payrolls in 2018.

- Employer firms with fewer than 100 workers employed 32.4%.

- Employer firms with less than 20 workers employed 16.0%.

If they're even still managing to keep the doors open.

But because Dr. Reich is a Leftist, he is obligated to blame big corporations for all the ills of the world. And being a government employee for probably all his life, we're pretty sure he has no idea how businesses operate.)

Another reason Social Security keeps up with inflation while the minimum wage doesn’t is that Americans who receive Social Security — elderly and politically active — are far more likely to vote and demand cost-of-living increases than are people living at or near the minimum wage. (Is Dr. Reich comparing a legislated minimum wage that is paid out of the pockets of businesses with a gargantuan social program funded with government-mandated taxes extracted FROM WORKERS' PAY? Really?

Social Security taxes reduce spendable income. So the minimum wage is needed to make up for the taxes taken by government. The cost minimum wage is passed on to the consumer, who pays higher prices for products, which reduces spendable income. Hmmmm.)

But don’t grow too complacent about Social Security. Republicans and much of corporate America would like to do away with it. As Wisconsin Republican Senator Ron Johnson put it: “Social Security and Medicare, if you qualify, you just get it no matter what the cost… We ought to turn everything into discretionary spending so it’s all evaluated.” (That's not the same as doing away with it...)

So is it ever going to be possible to raise the minimum wage? Yes.

I led the fight to raise it in 1996. (And Al Gore invented the internet.)

But don’t grow too complacent about Social Security. Republicans and much of corporate America would like to do away with it. As Wisconsin Republican Senator Ron Johnson put it: “Social Security and Medicare, if you qualify, you just get it no matter what the cost… We ought to turn everything into discretionary spending so it’s all evaluated.” (That's not the same as doing away with it...)

So is it ever going to be possible to raise the minimum wage? Yes.

I led the fight to raise it in 1996. (And Al Gore invented the internet.)

Republicans controlled both houses of Congress at the time. Everyone told me it was impossible. But I sensed that raising the minimum wage was a popular issue.

I asked Bill Clinton’s pollster to find out. He came back to me wildly enthusiastic. “85 percent of Americans believe the minimum wage should be raised!” he said.

Armed with that poll, I convinced Clinton it was worth the fight. Then I took the poll to Democratic leaders in Congress, who became equally enthusiastic.

It was a presidential election year, and Democrats immediately saw it as an issue they could bang over the head of Republicans. (Indeed. Democrats never pass on the opportunity to bang things over the heads of Republicans. Little has changed in 30 years. They're still lying, dissembling, and name calling just like they always have.)

I asked Bill Clinton’s pollster to find out. He came back to me wildly enthusiastic. “85 percent of Americans believe the minimum wage should be raised!” he said.

Armed with that poll, I convinced Clinton it was worth the fight. Then I took the poll to Democratic leaders in Congress, who became equally enthusiastic.

It was a presidential election year, and Democrats immediately saw it as an issue they could bang over the head of Republicans. (Indeed. Democrats never pass on the opportunity to bang things over the heads of Republicans. Little has changed in 30 years. They're still lying, dissembling, and name calling just like they always have.)

Fearing they would — and concerned about a voter backlash if they didn’t raise it — enough Republicans joined on to pass it.

But is it possible to include an automatic inflation adjustment in the minimum wage?

When I suggested it, Republicans balked. This didn’t surprise me.

What surprised me was that Democrats also balked. Why?

"If it’s automatic, then we can’t fight about it,” a senior Democratic senator explained. “And in presidential election years, it’s a fight we like to have.” (So it is a Democrat problem. This little admission is telling. We have always known that Democrats are not interested in fixing problems, because having the problem is more useful than fixing the problem.)

Bottom line: Even if Republicans control one or both houses of Congress in 2024, that would be a good year to try to raise the minimum wage again. As to including an automatic adjustment for inflation, though, I’m less optimistic.

But is it possible to include an automatic inflation adjustment in the minimum wage?

When I suggested it, Republicans balked. This didn’t surprise me.

What surprised me was that Democrats also balked. Why?

"If it’s automatic, then we can’t fight about it,” a senior Democratic senator explained. “And in presidential election years, it’s a fight we like to have.” (So it is a Democrat problem. This little admission is telling. We have always known that Democrats are not interested in fixing problems, because having the problem is more useful than fixing the problem.)

Bottom line: Even if Republicans control one or both houses of Congress in 2024, that would be a good year to try to raise the minimum wage again. As to including an automatic adjustment for inflation, though, I’m less optimistic.

No comments:

Post a Comment